Asan Karobar Card Account

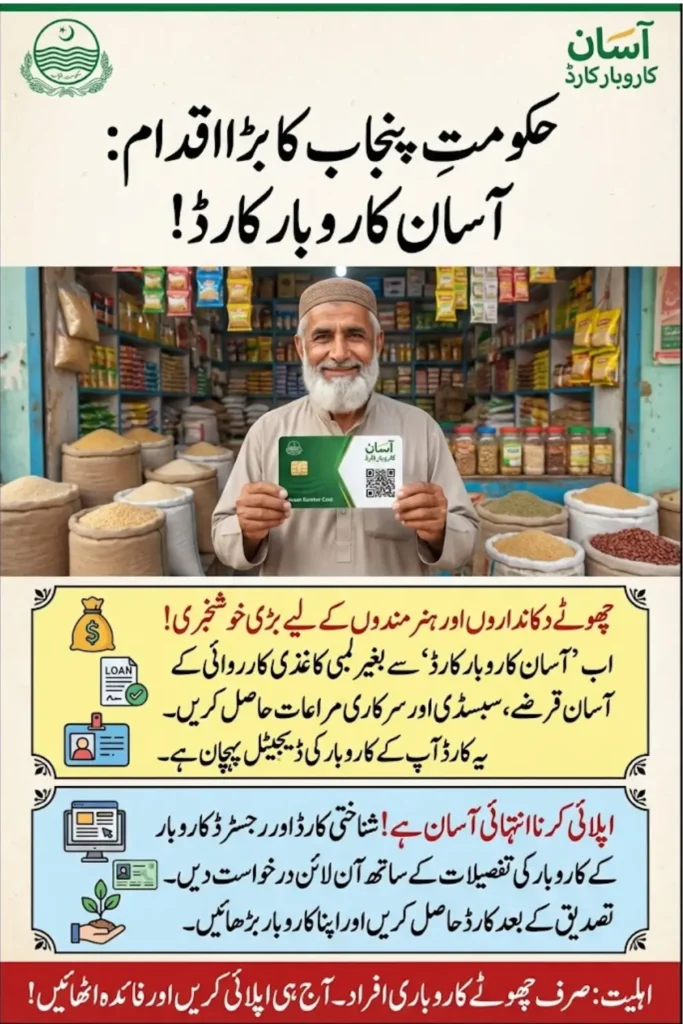

The Asan Karobar Card account is a Punjab Government initiative to help small business owners and micro-entrepreneurs. It provides financial support, easy access to government services, and verification of business identity. This account makes it easier to get loans, subsidies, and approval for schemes without long paperwork. The card is useful for traders, shop owners, freelancers, and small workshops.

The account acts as a digital identity for your business. With it, businesses can reduce manual processes and access support quickly. It also ensures transparency and keeps records of financial activities. Small businesses in sectors like retail, agriculture, services, handicrafts, and home-based businesses can benefit from this initiative.

Eligibility Criteria for Asaan Karobar Card Account

To open an Asaan Karobar Card account, applicants must meet certain requirements. First, they must be permanent residents of Punjab. Proof can include CNIC, utility bills, or domicile certificates. Applicants must also be 18 years or older at the time of registration.

The business must be small or micro in scale. Examples include retail shops, karyana stores, workshops, agriculture-related services, and freelance work. Applicants must also have a clean financial record. No ongoing loans, disputes, or suspended accounts are allowed. The business must be legally registered with valid documents like a registration certificate, shop license, or NTN details.

Common Application Errors and How to Fix Them

Many applicants face issues when applying for an Asaan Karobar Card account. The most common errors include:

- Incorrect personal or business details

- Expired or invalid documents

- Technical issues on the portal

- Eligibility mismatch

- Bank account discrepancies

To fix these errors, double-check all information before submission. Make sure CNIC, bank account, and IBAN numbers are correct. Use updated documents and valid bank accounts. Try different browsers like Chrome, Firefox, or Edge if the portal is slow. Stable internet helps prevent incomplete submissions. If problems persist, contact the official helpline.

Benazir Kafaalat Program Payment Date 13500 Complete Details for BISP 8171 Beneficiaries

Step-by-Step Process to Apply for Asaan Karobar Card Account

Applying for an Asaan Karobar Card account is simple. First, visit the official AKC portal. Create an account by entering your name, CNIC, mobile number, and basic business details. Next, upload required documents such as CNIC copy, business registration certificate, bank account information, and a passport-size photo.

After submission, the application goes through verification. Authorities check your business legitimacy, financial history, and bank details. Once verified, the Asaan Karobar Card account is issued digitally or physically. Applicants can then use it to access loans, subsidies, and government schemes quickly.

| Step | Action |

|---|---|

| 1 | Visit official AKC portal |

| 2 | Create an account with CNIC and details |

| 3 | Upload CNIC, registration, bank info |

| 4 | Submit application |

| 5 | Verification by authorities |

| 6 | Receive Asaan Karobar Card account |

Benefits of Asaan Karobar Card Account

The Asaan Karobar Card account provides financial support, easier government access, and business growth opportunities. It allows quick loans, micro-financing, and subsidies for small businesses. It also reduces paperwork and gives priority access to government schemes.

Other benefits include skill development programs, digital training, and access to marketplaces. Businesses also gain verified identity for banking and transparent record-keeping. This makes it easier to run and expand small businesses efficiently.

8171 Web Portal 2026 Update Check Your Rs. 13,500 BISP Qist Instantly

| Feature | With Asaan Karobar Card account | Without |

|---|---|---|

| Loan access | Fast & easy | Complicated |

| Document submission | Minimal | High paperwork |

| Government schemes | Priority | Limited |

| Business verification | Digital & quick | Manual |

| Financial transparency | Strong | Weak |

Official Helpline Number

For help with your Asaan Karobar Card account, Punjab residents can contact the official helpline. The helpline provides guidance on eligibility, application tracking, document verification, and technical issues. Calling during office hours ensures faster response and resolution of problems.

FAQs

Who can open an Asaan Karobar Card account in Punjab?

Any Punjab resident aged 18+ with a registered small business and a clean financial record can apply.

How can I fix eligibility mismatch errors?

Check that your CNIC, business type, and financial record meet all official requirements.

How long does approval take for the Asaan Karobar Card account?

Approval usually takes 7–14 working days depending on verification backlog.

Can freelancers apply for the AKC account?

Yes, freelancers and service-based workers can apply if they can verify their business activity.

Maryam Nawaz Asaan Loan Scheme 2025–26 Apply Online via Punjab Government Portal